Fourth Quarter 2022 - Type 2 Thinking

Submitted by Alsworth Capital Management, LLC on January 29th, 2023

The year 2022 was certainly a year to forget in investment markets. Throughout the course of the year, stock markets experienced steep declines, as well as several powerful “buy the dip” rallies. This behavior is consistent with past corrections from bubble level valuations. The S&P 500 index, representing large US companies, ended the year with a powerful rally off the October lows, but still ended the year down 18%. Developed international stocks* were down 14.5% and Emerging Market stocks* were down 20%. The US dollar* appreciated 8% for the year, which reduced foreign equity returns one-for-one. This works both ways though, as the dollar has declined substantially in recent months, giving non-US holdings a relative advantage.

Core investment-grade bonds* had a solid fourth quarter, gaining 2%. But this was still the worst year for core bonds, with the index dropping 13.0% for the full year. Gold* ended the year flat with a -0.5% return, though it has bounced up over 6% in 2023, as of this writing. Commodities* were up 16% on the year and Bitcoin* declined 64%. The Roundhill MEME ETF, which tracks a basket of “meme” or social media hyped stocks, declined 63%. There were also sub-asset classes that performed remarkably differently than the larger asset class returns would indicate. US Large Cap Growth stocks* ended the year down 29%, while US Large Cap Value stocks* were down “only” 7.5%. Floating Rate Loans* (specialty type of bonds) ended the year down 0.6%.

Investment Outlook and Portfolio Positioning

Reliable data sets measuring US investments only goes back to 1926. This past year was the first year in that 95-year span of history in which both bonds and stocks declined over 10%. The poor performance follows a long period of persistently positive returns in both asset classes and has been jarring for a lot of investors, especially young investors that haven’t experienced declines before. Prior to 2022, US stock markets exhibited bubble characteristics, which included the highest valuations in history by a multitude of metrics and gross speculative behavior in driving up exorbitant prices in certain stocks. We also experienced a new phenomenon in which investors gambled on “meme” stocks for sport, with no consideration for the fundamentals of the underlying companies. Accommodative monetary policy (low interest rates), coupled with aggressive fiscal policy (Congress cutting taxes and increasing spending) shares a lot of the blame for creating a bubble in many asset class prices, including stocks, bonds and real estate. High valuations leave investments vulnerable to unexpected events and the catalyst for the market declines in 2022 ended up being inflation. Pandemic related supply constraints crashed with free money COVID stimulus funds to create a spark that lit the inflation fire, then persistently low interest rates acted like gasoline. Many of the initial causes of inflation were in fact “transitory” like manufacturing disruptions, China COVID lockdowns and shipping bottlenecks. Fortunately, these factors have largely corrected at this point and inflation has dropped from the 8-9% level down to 6.5% as of the last reading. Further declines to around 5% in the near term are probable, based on current indicators, but driving inflation down to the Fed’s target of 2% appears unlikely for the foreseeable future. Our expectation is that inflation will hover around 4%, putting pressure on the Fed to keep rates higher for longer. The Fed has been aggressive in raising interest rates, however, it takes months for higher rates to work through the system and start to change behavior. Historically, when credit (borrowing) is constrained, a recession is induced. Currently, virtually every reliable indicator of impending recession is flashing red. There is little debate amongst market strategists concerning whether we will be facing a recession in 2023, though there is fierce debate about the severity. We have never escaped a recession without inflicting pain through higher unemployment and reduced

corporate earnings. We don’t expect this time to be different and we expect a protracted “stagflation” period with stagnant growth and elevated inflation. We continue to position the portfolio accordingly and in relation to our confidence in the expected outcome.

During difficult markets I am often asked why we didn’t put everything in cash while we were writing about high valuations for several years. I’m also asked if we should do more to incorporate technical analysis (basically tea reading) to better “time” market movements. The fact is that trillions of dollars are invested in markets and the brightest minds on earth are dedicated to trying to outguess other investors, with billions in riches as their reward if they are successful. To date, nobody has been consistently successful to the point that you could attribute it to having the ability to foretell the future. Nobody has been successful timing short term movements, as everyone is fooled by randomness in market behavior that looks like a “trend.” The most successful investors in history like Warren Buffet and Ray Dalio share a few strategies in common. They pay close attention to valuations and they make methodical moves based on probabilities and humility about their decisions.

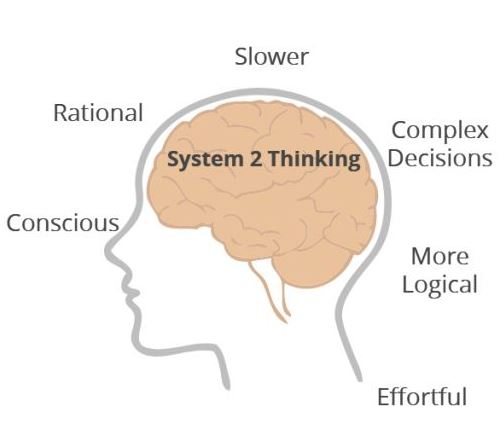

This approach is exemplified by that of successful bond manager, Scott Minerd, who unfortunately passed away in December 2022 at the young age of 63. Scott was one of the founders of an investment firm called Guggenheim Partners. We have several positions invested with the firm and I had the pleasure of meeting Scott personally in San Francisco, at a meeting setup by one of our consultant firms, Litman Gregory. When he founded his firm, he made the strategic decision to pursue a relatively new field at the time called “Behavioral Finance” and he enlisted famed psychologist, Daniel Kahneman to help improve their decision-making process. A basic tenant of their work was to separate the "type 1" gut feeling decision making from the “type 2” slow reason-based thinking. While intuition (type 1) has its place, reason and fact checking (type 2) are used to reduce the number of errors that shooting from the hip causes. They have successfully implemented type 2 thinking in their processes to build a successful $248 billion firm with over 900 fact checking employees. In reflecting on behavioral finance, I’ve found that Type 1 quick decision making tends to overweight whatever has happened recently and how it rhymes with past experience. As an example, I’m often told that this inflation spike is like the 1970’s and therefore we will repeat those experiences. Or if markets are down in a correction, it must mean that we will see 50% declines like we saw in the last two recessions. My recommendation is to lean on Type 2 analytics rather than relying on faulty quick decision intuition. With over 20 years of investing history, I suffer type 1 intuition and bias, let alone emotion, but I fight it every day. We rely on our consultants to stress test our models and expectations, and our process is structured around taking our time to make slow reasoned decisions based on imperfect probabilities of being right.

When we have rallies, we expect to continue to slowly reduce our stock allocations, until valuations improve. While we anticipate challenges ahead, we are confident that there will come a point when valuations look more attractive, and we can feel more comfortable slowly shifting back toward our long-term strategic allocations. Please feel free to setup an appointment anytime to review your financial plan or talk through your investment portfolio positioning.

Cordially,

Shane M. Alsworth, MBA, CFP®, CLU®, CIMA®

The views and opinions presented in this article are those of Shane Alsworth only

Sources: Morningstar/Ibbotson data, Ned Davis Research, BCA Research, iMGP Research

*US large stocks (S&P 500 Index), US large cap growth (Russell 1000 Growth Index), US large cap value (Russell 1000 Value Index), US small stocks (Russell 2000 Index), (Developed international stocks (MSCI EAFE Index), Emerging Market stocks (MSCI EAFE EM Index), Core investment-grade bonds (Bloomberg U.S. Aggregate Bond Index), Floating Rate Loans (S&P/LSTA Performing Loan Index), US Dollar (DXY Index), Gold (Aberdeen Physical Gold ETF), Commodities (Bloomberg Commodity Index)