Blog

We personally author periodic letters and presentations to our clients to provide an update on how we are managing their portfolios, our view on economic conditions, and important updates on financial planning topics. We post some of that content to this blog for public viewing. We hope you find the content useful.

The second quarter of 2025 proved to be one of the most volatile on record. The S&P 500 Index of large US stocks dropped over 19% from its recent high up to April 8th, shortly after the “Liberation Day” tariff threats. After the tariffs were postponed and reduced in magnitude, the index recovered all of these declines and end The S&P 500 Index, consisting of the largest public companies in the US, ended the year up 25%. This was the second year in a row with gains over 20%. The returns were led by large technology companies, particularly tho What is there not to like about last quarter? The stock market reached new highs with the S&P 500 gaining 5.9% in the third quarter, pushing its year-to-date return to 22.1%. Developed international stocks In the second quarter of 2024, the U.S. economy remained strong, much better than most economists were expecting when making forecasts a year ago. We have continued to be surprised by the strength of consumer spending and magnitude of corporate cash flowing into Artificial Intelligence related investments.Third Quarter 2025: All That Glitters Isn’t Gold

Submitted by Alsworth Capital Management, LLC on October 24th, 2025

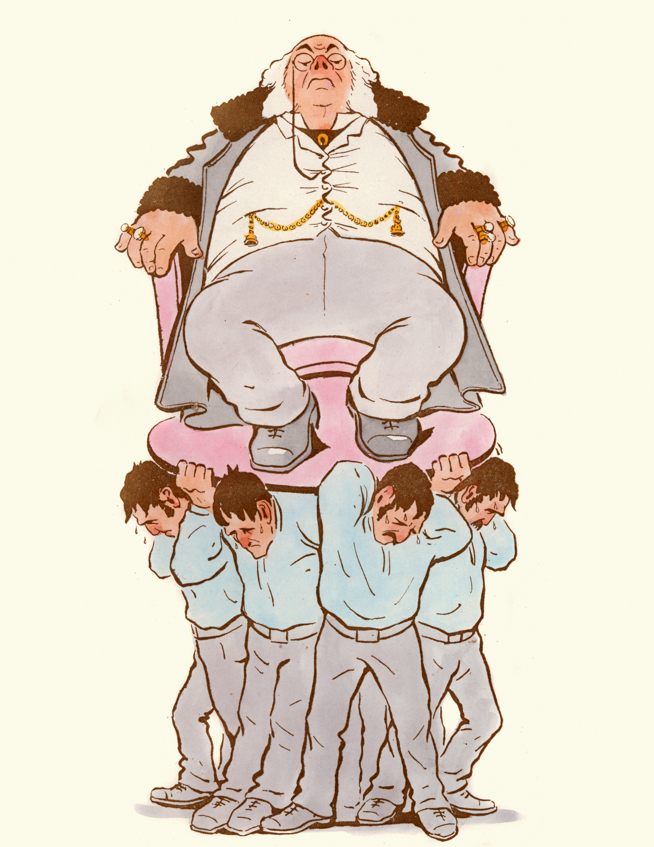

Second Quarter 2025: One Big Beastly Burden

Submitted by Alsworth Capital Management, LLC on July 16th, 2025

Market Recap

First Quarter 2025 - Ripple Effects

Submitted by Alsworth Capital Management, LLC on April 25th, 2025

April 7, 2025 – Incremental and Slow

Submitted by Alsworth Capital Management, LLC on April 7th, 2025

April 03, 2025 - Markets React to Liberation Day!

Submitted by Alsworth Capital Management, LLC on April 3rd, 2025

Fourth Quarter 2024 - Investing for Sport

Submitted by Alsworth Capital Management, LLC on January 19th, 2025

Market Recap

Third Quarter 2024 – Don’t Bet on the Unsure Thing

Submitted by Alsworth Capital Management, LLC on October 30th, 2024

Market Recap

Second Quarter 2024 - The Market Craves Certainty

Submitted by Alsworth Capital Management, LLC on July 26th, 2024

Market Recap

First Quarter 2024 – Don’t Put All Your Eggs In the Shiny Basket

Submitted by Alsworth Capital Management, LLC on May 9th, 2024