Second Quarter 2025: One Big Beastly Burden

Submitted by Alsworth Capital Management, LLC on July 16th, 2025

Market Recap

The second quarter of 2025 proved to be one of the most volatile on record. The S&P 500 Index of large US stocks dropped over 19% from its recent high up to April 8th, shortly after the “Liberation Day” tariff threats. After the tariffs were postponed and reduced in magnitude, the index recovered all of these declines and ended the quarter up 6.2% for the year-to-date period! Investors coined the jubilant bid for stocks the “TACO” trade, for “Trump Always Chickens Out”. As more tariff announcements were made, the market continued to ignore them as negotiating tactics and assumed that more benign trade deals would ultimately be secured. Developed International stocks (MSCI EAFE Index) ended the quarter up 19.5% year-to-date. Emerging Markets (MSCI EM Index) were up 15.3% for the first half of the year. Smaller US companies (Russell 2000 Index) recovered 8.5% for the quarter but are still down 1.8% year-to-date. The Bloomberg US Aggregate Bond Index was up 4% for the first half of the year and Gold finished with an impressive 25.9% year-to-date return.

Economic Outlook

The June inflation numbers showed an uptick in consumer prices, which continue to be “sticky” at an annual rate of 2.7%. This is before the impact of tariffs has had a chance to show up meaningfully in the data. Markets and the Federal Reserve are still waiting for concrete data to assess how tariffs will impact the economy. The average rate of US tariff taxes imposed on imports has historically been around 2.5%, but it has spiked to 14.5% under Trump’s initial, often changing, set of executive orders. Normally, tariff policy is set through a long, drawn-out process in Congress, which gives tax collectors time to establish the rules and set up the systems for collecting tariff revenue. The collection of new tariffs is just now starting to commence, and we expect to see the impact in the second half of this year. Unemployment has increased only slightly, but the labor market is showing signs of deterioration. Companies are waiting to hire until they see how tariff policy and trade negotiations pan out, which has caused new hiring to plummet. There are no signs of mass layoffs, but the shortage of labor has ended. Currently, there is only one job posting for every one person looking for a new job. The pandemic induced housing shortage has also ended. The supply of housing is back to pre-pandemic levels and there has been a rapid increase in the inventory of homes listed for sale. Home prices have declined nationally for the last few months. The average percentage of income that must be allocated to mortgage payments has spiked to levels not seen since the 1980’s, likely putting further pressure on housing prices and home purchase negotiations going forward.

Despite this confluence of recessionary early warning signs, the economy is holding up reasonably well, so far. The evidence is increasingly pointing toward an economic slowdown, but there is no indication that this means we will necessarily experience an official recession, let alone a protracted downturn in the economy. There is an ongoing race for dominance in the artificial intelligence space, which is causing big profitable technology companies to spend obscene amounts of money (at great expense and damage to their profits) to avoid becoming obsolete. As they trip over one another to throw money at nuclear energy projects, data centers and computing power, they are providing a large stimulus to the economy, which is helping to offset the drag from the elimination of pandemic era stimulus spending. This has also been the one bright spot, helping to justify the stock market’s strong rally and resurgence to record valuations. The market is not pricing in anything close to a recession at current valuations and they are looking through economic weakness to focus on the expectation of future Federal Reserve interest rate cuts and short-term stimulus from tax cuts.

You are no doubt aware that the “One Big Beautiful Bill Act” passed and was signed into law by President Trump, extending the tax cuts from the 2017 Tax Cuts & Jobs Act, which was implemented in his first administration. The OBBBA included many new provisions, including reducing taxes on corporations and large estates, increasing the child tax credit, a temporary deduction against Social Security income, and increasing the deduction for state and local taxes to $40,000. The tax cuts were partially offset by cutting nearly $1 trillion from Medicaid, the government health insurance program that covers the poor and long-term care costs for the elderly. On net, the Congressional Budget Office (CBO) projects that the bill will add $3.4 trillion to the national debt. There are many provisions in the new law that will impact your tax return. Some of the provisions are short term, only lasting until 2028, when a new administration will need to determine whether they get extended. We will be sending out separate communications with the highlights of the new laws and how they may impact you.

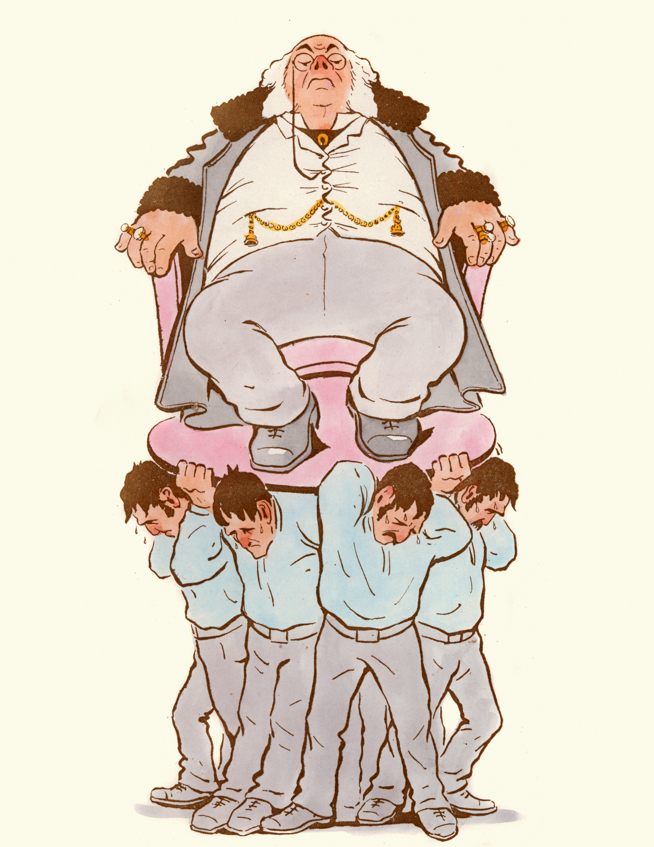

There continues to be no political appetite for addressing our alarmingly high national debt. At a staggering $37 Trillion, our US National Debt represents 120% of GDP (US Income), a level far exceeding the 100% of GDP “redline” that has caused currency crises for countries throughout history. For perspective, if you had a big bag filled with a million dollars, it would take one million of those bags piled up to equal one trillion dollars. At $37 trillion in debt, each and every US taxpayer is essentially saddled with $323,000 in national debt. The debt is at a level that can’t be ignored. It has turned into “One Big Beastly Burden” that is having immediate impact on the value of the US dollar and will continue to exert influence on asset prices until it is confronted. This year, we have seen a dramatic outflow of money as foreigners have been shifting investments outside of the US. They are demanding higher interest rates to justify the risk of investing in the US. Treasury bond investors are concerned that we will continue to devalue our currency, so that they will get paid back at maturity with weaker future currency. Instead of borrowing at 1% or 2%, as we have for decades, we now have to pay around 5% to borrow money. As I’ve outlined in prior commentaries, the amount that we pay in interest on our debt ($1 trillion) now exceeds what we pay for any other budget item other than Social Security ($1.5 trillion) and Medicare ($1.1 trillion). As more of our budget is allocated to interest debt payments, it is going to crowd out our ability to respond to ever increasing natural disasters, increasingly fraught geopolitical risks and the challenge from China’s competitive power. We are past the inflection point and the value of the US dollar has declined over 10% this year. This is the primary reason international investments have outpaced US investments this year and it is the primary reason that Gold has performed so strongly.

Portfolio Positioning

We believe that the risk of an economic slowdown coupled with higher inflation (stagflation) is not adequately reflected by current stock valuations. We are meaningfully underweight US stocks and Small Company stocks, as a result. We are overweight defensive stocks versus technology stocks, due to the disparity in valuations. We believe that the path of least resistance is further depreciation in the value of the US dollar. We therefore have a significant allocation to Gold, and we maintain a full allocation to non-US assets, as a hedge. While we are concerned about valuations and an economic slowdown, we are not expecting or positioning for a deep or protracted recession. The investment landscape is as complex as anytime I can recall, but there continues to be compelling investment opportunities around the world. We thank you for your continued trust in our firm and we welcome any questions.

Cordially,

Shane M. Alsworth, MBA, CFP®, CLU®, CIMA®

The views and opinions presented in this article are those of Shane Alsworth only (disclosures on back)

Sources: Morningstar/Ibbotson data, BCA Research, Litman-Gregory Advisor Intelligence, iMGP