Third Quarter 2024 – Don’t Bet on the Unsure Thing

Submitted by Alsworth Capital Management, LLC on October 30th, 2024

Market Recap

What is there not to like about last quarter? The stock market reached new highs with the S&P 500 gaining 5.9% in the third quarter, pushing its year-to-date return to 22.1%. Developed international stocks (MSCI EAFE) gained 7.3%, finishing ahead of domestic stocks in the three-month period. They are up 13% year to date. Emerging Market stocks (MSCI EAFE EM) finished the quarter up 8.7% and are up 16.9% year-to-date. Investment Grade bonds, as represented by the Bloomberg US Aggregate Bond Index, gained 5.2% for the quarter and is up 4.5% year-to-date. High Yield bonds with lower credit quality were up 5.3% on the quarter lifting the year-to-date returns to 7.9% (ICE BofA Merrill Lynch HY Index). Gold shot up 13.1% over the quarter and is up 27.3% year-to-date.

Investment Outlook

Two of the key tenets in investment management are to avoid trying to “time” the market and remain calm and composed through volatility. This “timing” the market idea gets misconstrued in my opinion, since any choice that we make in how to allocate to various asset classes is intentional and must reflect some decisions that were made. If we decide to invest in an index, like the S&P 500, we are deciding to invest in a portfolio that is dominated by the largest corporations in the US only. We are making a decision to hold a portfolio with 40% of the money allocated to stocks in one single industry, the Information Technology sector. We are choosing to invest in a portfolio that is trading at the highest valuations in history by many common metrics. Whether it was a fully informed choice or not, this choice is a form of market timing. In my opinion, the negative connotation of trying to time the market should be stated instead as two rules. 1. Don’t make investment decisions based on predictions that you have no way of guessing how likely they are to be correct. 2. Don’t ever assume your predictions are going to be 100% correct. That pushes the tenet of remaining calm and composed through volatility out to the number three spot. This one is probably equal parts innate personality and learned (relearned) behavior, but it’s still worth remembering.

We develop a base case, bear case and bull case in our scenario modeling. We then weigh the probability of each scenario based on our interpretation of the data. We never allow the probability of any scenario to be set at zero and we are skeptical of any grossly disproportionate weightings. This is done to remind ourselves that we are never going to be perfect at predicting an unpredictable future, and that we need to make a conscious choice that is informed by all reasonable possibilities. This also keeps us from overconfidently shifting our allocation too aggressively based on our best guesses. Additionally, we avoid using inputs that are based on unknowable outcomes.

At the beginning of the year, the economic data indicated a trend toward slowing economic growth. This coupled with high interest rates has typically resulted in a slowdown in hiring, weakening of consumer spending and ultimately a recession that lasts until a balance can be obtained. The probabilities were skewed heavily toward this likely result, but the recession never materialized. Instead, the economy is still holding steady with a positive growth rate. The rate of inflation has come down dramatically and is approaching the Federal Reserve’s target of 2%. In short, the good economic figures have been a surprise. The primary cause for the economic surprise has been the level of government deficit spending, which has helped fuel continued growth through government jobs and contract spending. This is by far the highest level of government deficit spending during a period of low unemployment in our history. In addition, the arms race to invest in Artificial Intelligence tools and related energy projects has given the economy a boost. Earnings have been generally positive, but the primary surprise for the stock market has been the higher and higher valuations (price) that investors have been willing to pay, rather than any significant improvement in fundamentals. If the economy can improve more broadly beyond deficit spending and earnings can improve more broadly across the market sectors, we could see more positive growth from areas outside of tech. There are encouraging signs that this may be playing out. Though, it would be hard to maintain the pace of gains experienced so far this year.

Elections

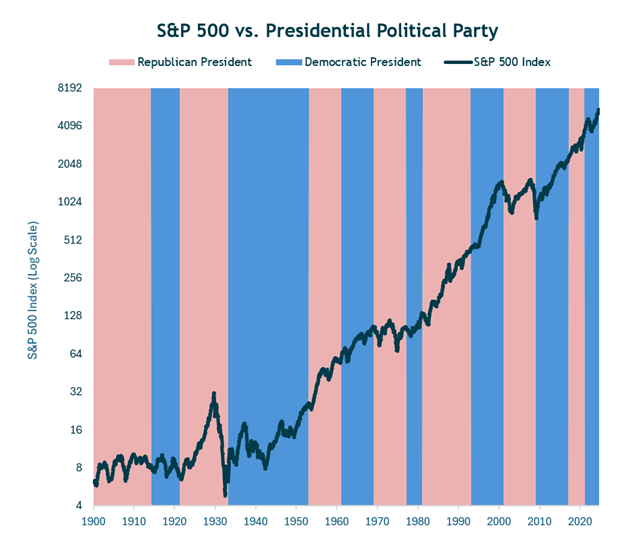

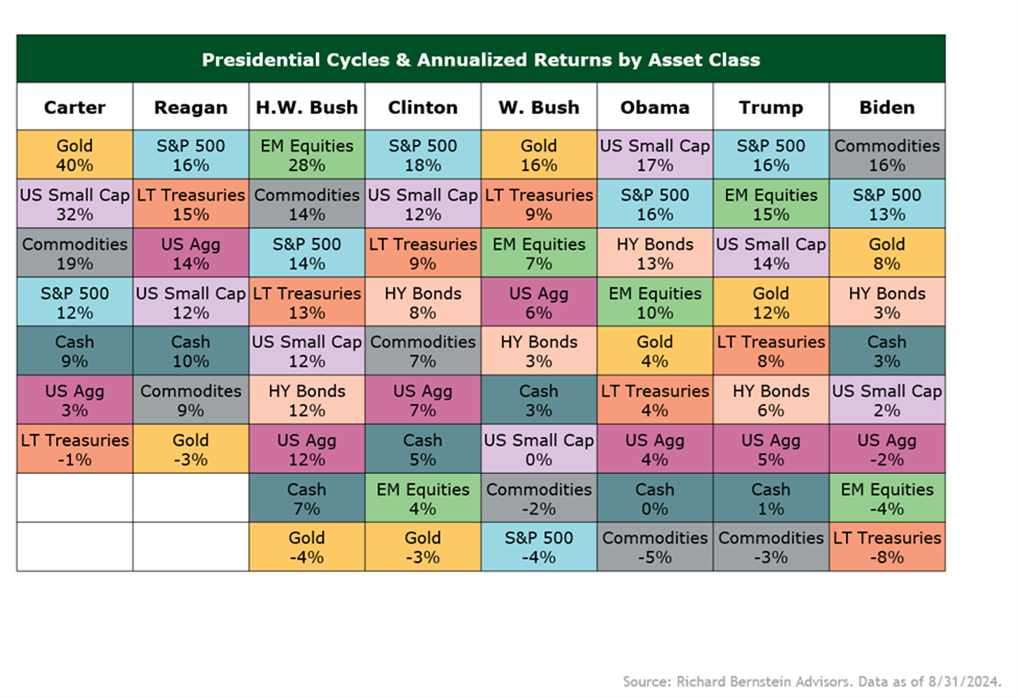

The dominant question that I have received over the last three months has been related to how we are positioning for the upcoming US election. I don’t mind the question, and I appreciate that it is front and center on the minds of many of us. There are a couple of important points that I would like to make. This election is different than most of the past presidential elections in one important way. It is a toss-up tie as assessed by any reasonable polls, the betting markets, and differences in stock sector trading attributed to political forecasts. This puts this election in the key tenet number one category; don’t manage investments based on predictions when you have no way of guessing the likelihood of the outcome. This election is clearly in the margin of error, and we will all be waiting for the results with no rational justification for being “surprised” by the eventual outcome. It could go either way. Another important point that I like to make about elections is that they have absolutely no predictable pattern of impacting markets. I have included two charts with this letter to help illustrate the history. The first chart shows the S&P 500 Index of US stocks as a performance chart with pink and blue bars representing whether a Republican was President (pink) or a Democrat was President (blue). The results are obvious that no discernable pattern exists. The second chart shows a table of performance for various investment segments under recent administrations. No discernable pattern again. I’ve read countless studies over the years, many of which are updated every election cycle. Some of them go into substantially more detail. Many categorize periods when one party controls the presidency and one chamber or both in Congress. There are a multitude of ways to parse and dissect the data. The conclusions are all the same. This isn’t to say that political choices do not matter to the markets. It’s simply that the political party in power is only one of many factors and it isn’t a dominant or predictable factor. We aren’t making any adjustments to the portfolio based on predictions of the election outcome. We hope for and expect another peaceful transfer of power followed by clear communication of policy goals from the new administration. It is probably too much to expect a healing of the divisions in our society that express themselves through politics, but we can hope for it, none the less.

Portfolio Positioning

Our concerns about higher recession risk have waned with recent data. The risk isn’t eliminated, but it is less likely as the “soft-landing” scenario that the Fed has been targeting appears to be playing out. We remain concerned about historic valuation multiples being paid for stocks in the Information Technology sector and we continue to have a low allocation to the sector. We shifted more of the portfolio toward lower valuation stocks at the expense of our alternative allocation. We increased the allocation to small company stocks, which look attractive under a soft-landing economic scenario. We have maintained a sizeable allocation to Gold since 2019, as a hedge against the US dollar, considering the level of deficit spending and debt accumulation in the US. We are currently approaching $36 trillion in US National Debt, which equates to over $106,000 per US citizen. Our national annual deficit is now equal to 122% of our annual GDP. Historically, problems occur when deficits exceed 100%. The Committee for a Responsible Federal Budget (CRFB), the prominent nonpartisan think tank, has estimated that the proposals put forward by the Harris campaign would result in an additional $3.95 Trillion added to our national debt over the next decade. The proposals put forward by the Trump campaign would result in an additional $7.75 Trillion added to the debt. Since neither party is making any attempt to address this issue, we have higher confidence in our Gold allocation and have added slightly to the position.

The bond markets are reacting to the deficit and debt story, with long-dated bonds bucking the Federal Reserve’s lower interest rate trend. Longer dated bonds are rising, as the bond market demands higher yields for taking the risk of holding US Treasury debt overtime. We believe this is a theme that will become more important once the election is over and we will be making adjustments in the portfolio in the coming weeks to concentrate on more intermediate term bonds.

We thank you for your continued trust in our process and we welcome any questions or feedback that you have.

Cordially,

Shane M. Alsworth, MBA, CFP®, CLU®, CIMA®

The views and opinions presented in this article are those of Shane Alsworth only (disclosures on back)

Sources: Morningstar/Ibbotson data, Ned Davis Research, BCA Research, Litman-Gregory, iMGP